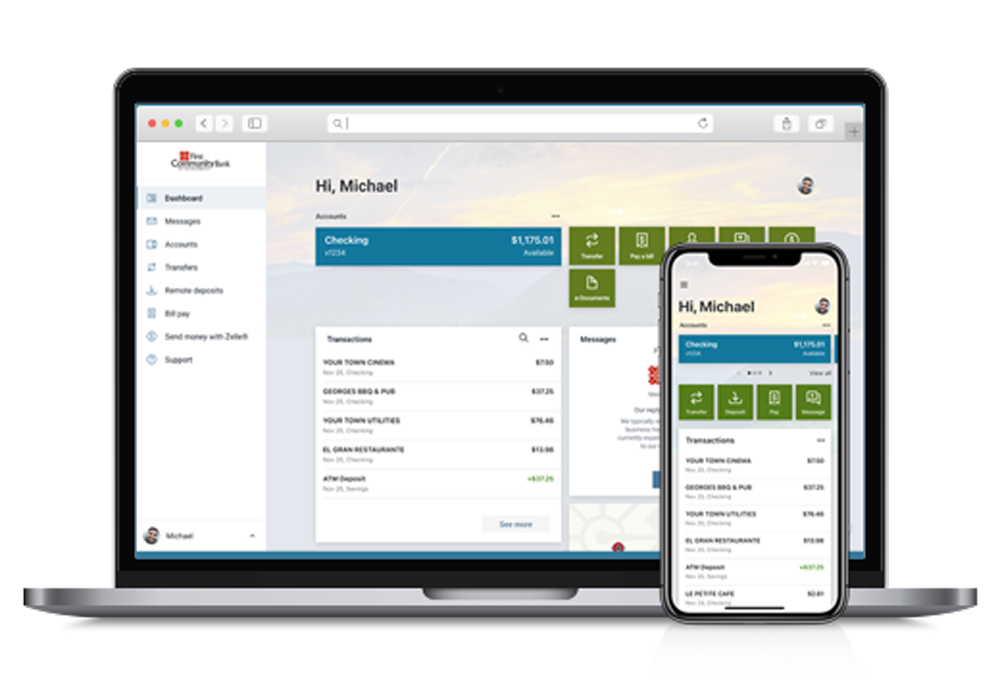

Experience seamless connectivity and dependable performance with First Community Bank's digital banking solution for your business.

Learn more about the following solutions making business easier.

More information to help prevent fraud loss.

Help you create more predictable cash flows.

Guard your business against loss with this early fraud detection service.

You will improve cash flow by depositing checks anytime.

Don't let your cash sit idly in a checking account

User Management

Manage permission of users' account and individual access.

The secure way to move money quickly.

Control your cash flow and avoid bounced checks, theft, or mistakes.

Solutions to manage daily transactions, cash flow, and reporting information.

Close your books more quickly.

With Account Reconciliation, we'll send a report showing all checks cleared for easy reconciliation. These reports will help spot fraud, maintain more balanced financial records, and close your books more quickly at the end of each cycle.

BENEFITS:

- Prevent fraud loss with our detailed account reconciliation report

- Save time and money by simplifying your bookkeeping process

Streamline the way you send and receive payments.

Leverage the Automated Clearing House (ACH) Network to quickly and easily distribute funds to vendors, employees, or your own business accounts or collect payments from your customers.

ACH Origination allows you to initiate electronic transactions through the ACH Network. This makes it much simpler for you to distribute funds to your own accounts, your vendors' accounts, or even your employees' accounts for payroll and expense reimbursements. You can also consolidate cash from your own business accounts at other institutions or collect payment from your customers' accounts.

ACH Payments

Using the ACH Network to make payments instead of writing checks is not just easier, it can also help you save time and money while assisting in reduced fraud.

- Lower administrative costs. Reduce the administrative costs associated with check preparation, mailing, and reconciliation, as well as stop-payment and reissue costs for lost or stolen checks

- Provide employee convenience. Offer convenience and time savings to employees by sending payments directly to their accounts

- Manage cash flow better. Control timing of disbursements to take advantage of vendor discounts and predict when your account will be charged

- Mitigate fraud. Help to eliminate checks that include sensitive account information

ACH Receivables

Improve your cash flow management while helping to mitigate risks and minimizing administrative tasks by receiving payments to your company through the ACH Network.

- Improve cash flow forecasting and funds availability. Create payment schedules to time incoming payments

- Expedite payment collections. Eliminate mail and check processing float to manage receivables with more predictability

- Minimize administrative tasks. Free up staff time previously set aside for depositing checks and tracking and collecting late payments

- Lower risks. Accelerate return item information, which can be reported as soon as the next business day

Fraudulent checks don't stand a chance.

Positive Pay is an early fraud detection service that verifies all checks written from your account. If a check strikes you as suspicious in any way, we'll help you with it immediately. That way you're not alone when protecting against loss.

BENEFITS:

- Ability to pay or return payments

- Get notified of potential check fraud as soon as it happens

- Proactively manage check fraud risk

- Reduce fraud losses and avoid the fraud recovery process

- Reinforce your check-writing controls and policies

Deposit checks online and you'll save more than time.

With Remote Deposit Capture* and an internet connection, you can scan checks and transmit them directly into your account. You can even scan several checks at once, saving time and accelerating your cash flow.

Remote Deposit Capture automatically creates images of your check, which you can save on your computer for future reference. And just like making a deposit at most branches, you have until 6 p.m. to deposit them into your account for that business day.

BENEFITS:

- Minimize manual deposit preparation tasks

- Eliminate trips to the bank

- Supports multiple authorized accounts

- Allows for later deposits with quicker access to funds

- Provides real-time email notifications when deposits are received by the bank

- Offers multiple reporting options to access and export data and images of scanned checks and supporting documents

We'll make your sure money never sleeps.

Investment Sweep Services

Cash is one of your most important resources, so don't let it sit idly in a checking account. Our Investment Sweep Services let you earn interest on every penny of your extra cash.

BENEFITS:

- Earn interest on excess cash

- Take advantage of relationship pricing

Credit Line Sweep Services

Our Credit Line Sweep Services will automatically transfer funds from your line of credit to your checking account as needed. It'll also move excess checking balances to pay down your credit line. This helpful service offers valuable peace of mind, knowing that shortfalls in your checking account are automatically covered.

BENEFITS:

- Maintain a preferred balance

- Reduce interest expense

- Improve your cash flow

- Have peace of mind that incoming debits are covered

User management offers granular permissions so that organization admins can tailor an individual’s access to money movement. Organization admins control which entitlements their organization users interact with as well as which accounts the users can or cannot access to move funds.

BENEFITS:

- Manage User permissions for how the user views and interacts with entitlements

- User permissions may vary but can include ACH, Bill Pay, Card Management, Positive Pay, Stop Payments, Transfers, User Management, and Wires.

- Able to enable or block account access at the User level.

The power to move money quickly and conveniently.

Online wire transfers are the most convenient and secure way to transfer funds. With our Digital Business Banking service, you can easily initiate online wire transfers and set up a dual control process for extra security.

BENEFITS:

- Save money by processing wire transfers online

- Reduce administrative tasks by creating payment templates for future use

- Protect your privacy by directly transferring money from one bank to another

- Transfer money faster than mailing a check

- Get email notifications of incoming and outgoing wires

Control cash flow while avoiding bounced checks, theft, or mistakes.

Perfect for businesses that manage transfers for separate payroll, merchant processing and petty cash, or that have multiple divisions, stores, or operating units. Funds are disbursed to individual ZBA accounts only when necessary to cover checks or debits.

BENEFITS:

- Multiple account balances are concentrated into one, centralized account

- Eliminate the need for manual transfers between bank accounts - debit or credits

- Concentrate funds, eliminating idle balances and simplifying account management

- Maintain required balances for disbursements while maximizing excess balances

- More than one ZBA can be linked to the primary account

- Separate statements for each account

Partner with our Commercial Services Team

Whether your business is a start-up or has been established for years, our team can provide the support and tools to help it grow, fitting the future.

-

Local experts to help grow your business

-

Set your business up for success with Digital Banking

-

Put more secure payment processes in place with ACH services

-

Help you make the most of your cash on hand (ask about our Sweep Services)